Earlier in August when the rupee had fallen less than the currencies of most developing economies after the China crisis sent shockwaves through world markets, the murmur was to utilize the situation to portray India as a new engine & capture the export markets from China.

In December 2015, CAD arises when a country's total import of goods, services and transfers' is greater than exports. A higher CAD usually leads to a depreciation of the country's currency. This in turn, can trigger inflation through the import channel.

The rupee may further go lower after India's Current Account Deficit (CAD) widens. The Economists and International research firms convey this widening deficit is something you're going to have to live with for more than next 2 to 3 quarters.

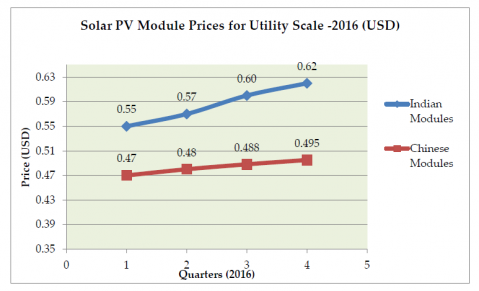

This worries for the Solar Utility Scale projects planned & in pipeline to get completed by Q2, Q3 & Q4 of 2016 which means module, inverters and the steel prices may see the major fluctuation. As per our internal analysis, the prices of Modules have gone up and we expect it would further shoot up despite rupee depreciation against dollar. Moreover the shortage of Cells and modules have further burdened the project developers & EPC companies.

The best option is to complete or place order for the procurement of the major components as Solar Modules, Inverters & MMS at the earliest & by Q1 of 2016. This could let the IPPs/ Investors/ EPCs to save the maximum out of the procurement.